The China Alternative – Vietnam

The China Alternative is our series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Vietnam.

The China Alternative is our series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Vietnam.

By Jane Shi

Apr. 11 – As raw materials and oil prices rise, the largely manufacturing-based economy of Vietnam has struggled to balance development against the necessity of controlling inflation.

Similar to China, Vietnam is a single-party state. The country experiences relative political stability, with occasional disruption occurring in the form of disputes between political officials near times of appointment changes, protests over aggressive land seizures, and corrupt bureaucracy at state and local levels.

Prominent issues of social control at this time and for the foreseeable future include tighter restrictions on and persecution of religious and ethnic-minority groups, and seizure of religious property. The New York Times recently published an exposé on the intensified crackdowns of underground religious gatherings of the Montagnards – hill tribe minorities – who have largely converted to Christianity over the last 500 years. Coupled with greater economic development and the population spread of lowland Vietnamese into traditionally minority-owned property, the religious aspect affects land rights of churches and other related property.

Territorial disputes in the South China Sea between Vietnam, China, Taiwan, Malaysia, the Philippines, and Brunei will continue to be a challenge to Vietnam’s ability to develop friendly foreign relations with its neighbors. The land in question contains high-traffic shipping routes, fish, and possibly significant deposits of oil and natural gas. Multilateral discussions for a resolution are currently being pushed by the Association of Southeast Asian Nations (ASEAN).

Vietnam’s economy in 2010 suffered major inflationary and currency devaluation problems. Consumer prices increased 13.89 percent in March of this year from the previous year, with expected increase in 2011 averaging 14.3 percent, compared to 9 percent in 2010. The rapid inflation is due to both higher prices of international commodities and downward pressure on the Vietnamese dong. The Economist Intelligence Unit estimates world crude oil prices to rise by 13 percent and food by 27 percent in 2011. Vietnamese policymakers have already increased electricity, petrol, and diesel prices by 15 percent, 17 percent, and 24 percent, respectively, in the first three months of this year.

A lack of confidence in the dong is also creating a national run on banks’ foreign reserves as the U.S. dollar makes up roughly 20 percent of the money used in transactions within the nation. The dong to dollar exchange is expected to depreciate from VND19,127:US$1 to VND23,873:US$1 by 2015. In October of last year, the International Monetary Fund estimated Vietnam’s foreign currency reserves at US$14.1 billion, which amounted to less than two months of imports. With such little in reserve and a continued trade deficit, the government is hard-pressed to find an easy resolution.

Nonetheless, in attempts to curb inflation, Vietnamese Prime Minister Nguyen Tan Dung passed a policy resolution in February of this year to narrow the budget deficit to less than 5 percent of GDP, cut credit growth to less than 20 percent, and lower the money-supply growth target to between 15 and 16 percent. The State Bank of Vietnam is also now requiring all state-owned enterprises, which produce roughly 40 percent of annual GDP, to sell back their U.S. dollar holdings to banks. The deficit has already dropped from 6.2 percent to 5.9 percent in 2010 from previous year, but as expenditures on infrastructure and social welfare remain high, the deficit will struggle to drop below 5 percent.

Economic production and competitiveness may well override policymakers’ emphasis to control inflation, as shown by past occurrences of premature lifts on restrictions as soon as hints of economic recovery present themselves. For instance, after the initial wave of credit crisis shock in 2009, Vietnam moved forward with rapid expansion that resulted in double-digit inflation rates by end of 2010. Inflation is still expected to stay high, averaging 13.3 percent through 2011, without a drop until at least 2012, with an expected average of 6.8 percent.

Consistency in Vietnam’s monetary policies will be spotty at best, as the government struggles with multiple fiscal and currency issues. The outstanding public debt rate in 2010 was nearly 57 percent of GDP. Though exports increased by 25 percent between 2009 and 2010, the value of total imports remains higher. In March, the SBV mandated all banks to gradually decrease their “non-productive sector” loans—e.g. real estate and securities— to 22 percent by the end of June and to 16 percent by the end of 2011. Penalty of failing to do so is a doubling of reserve requirements from the current rate of 1 to 3 percent.

Overall, economic growth in Vietnam is expected to average 7.2 percent in the next five years. Growth in investments, exports, and consumption – driven by better labor markets and higher wages – is expected to contribute to a stronger Vietnamese economy. A minimum wage increase of 14 percent, effective May of this year, will raise the monthly cost of basic labor from VND730,000 to VND830,000 per worker.

The government is also moving forward with the liberalization and semi-privatization of SOEs over the next five years, though more slowly and with greater emphasis on the financial health of SOEs after Vinashin’s (Vietnam Shipbuilding Industry Group) debt default on its first payment on an international syndicated loan in 2010.

Foreign interest for Vietnamese manufactured goods is still significant for investors from China, the United States and other developed economies. Retail and apparel, consumer goods, metal and mining, and machinery and industrial goods made up the majority of 2009 total exports at 13 percent, 10.5 percent, 9 percent, and 8.5 percent, respectively. The United States was Vietnam’s top exporting partner country, with 20 percent of Vietnam’s exports heading to U.S. ports in 2010. China was by far Vietnam’s largest source of imports with China claiming 23.8 percent of all imports in 2010.

While China is currently transforming its economy to a higher level of production development in more technical sectors such as IT and value-added services sectors, Vietnam has a significantly large unskilled labor force, which plays competitively well for low-skilled production in industries such as retail and apparel.

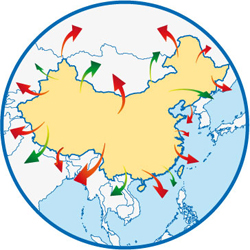

Though Vietnam lags behind China in its offerings for proximity to experienced suppliers, customers, complex rail, air, and ship networks, large logistic capacities, quick times to production and market, infrastructure, and vast energy supply, Vietnam may prove to be a valuable sea-bordering country for investment, especially in the manufacturing of exported goods, as China increases efforts to move manufacturing hubs and its labor population inland and westward by increasing costs in coastal regions

Vietnam’s overall ranking in the World Bank’s 2011 Ease of Doing Business index is also improving with an increase of 10 points from previous year to 78. In areas such as starting a business, dealing with construction permits, receiving credit, and paying taxes, Vietnam is no doubt developing a better economic business environment for investors.

As the country and its government continue to address the convoluted issues of monetary policy, social welfare, and relations with neighboring nations, it is difficult to determine the exact impact of these on the business environment in Vietnam for foreign investors in the future. But with the government’s eye on stronger economic competitiveness and greater export production values, it is likely that the environment will progress favorably.

Dezan Shira & Associates is one of Asia’s largest boutique professional service firms providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China, Hong Kong, Vietnam and India.

In Vietnam, the firm maintains offices in Hanoi and Ho Chi Minh City. For advice on corporate establishment or market entry in Vietnam, please contact vietnam@dezshira.com or download the firm’s brochure here.

Related Reading

The China Alternative

The China Alternative

Our complete series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity.

China’s Neighbors

China’s Neighbors

This unique book is an introductory study of all 14 of China’s neighbor countries: Afghanistan, Bhutan, India, Kazakhstan, Kyrgyzstan, Laos, Myanmar, Mongolia, Nepal, North Korea, Pakistan, Russia, Tajikistan and Vietnam.

Operational Costs of Business in China’s Inland Cities

Operational Costs of Business in China’s Inland Cities

It is widely held that land and labor costs in inland provinces offer quite significant cost savings over major east coast and southern cities. In this issue, we take a quick look at the numbers behind these beliefs.

Coastal China, Inland China, India or Vietnam for Your Sourcing Business?

- Previous Article China Briefing Releases New China Tax Guide for 2011

- Next Article China-India Business Update: Apr. 12